A Nearing Deadline for PPI Claims

Press release January 16, 2013 BusinessBankers & FSA Attempt to Strike a Deal

A rough deadline for the end of Payment Protection Insurance (PPI) claims has been suggested by the British Bankers Association (BBA) as the summer of 2014.

The BBA is and Financial Services Authority are currently negotiating a cut-off date for consumers to claim back any mis-sold PPI they received when taking out a loan, credit card, mortgage or similar financial product.

In return for ending the scandal, the banks have offered to fund widespread advertising in an attempt to raise public awareness of the nearing deadline.

There are no official deals or deadlines yet, as talks are still on-going, but a couple of potential solutions to implementing a deadline have been revealed:

- The Financial Services Authority would consult on new rules for claiming back PPI, however, new legislation might be required for this.

- Current regulations on claiming back PPI (i.e. people have six years to lodge a complaint, or three years if they originally notice after that initial six year period has expired) will stand, and a marketing campaign regarding the deadline will alert people to a three-year cut-off point.

If banks and customers can’t agree on a financial settlement, the Financial Ombudsman Service (FOS) deals with cases to come to a final, unbiased outcome.

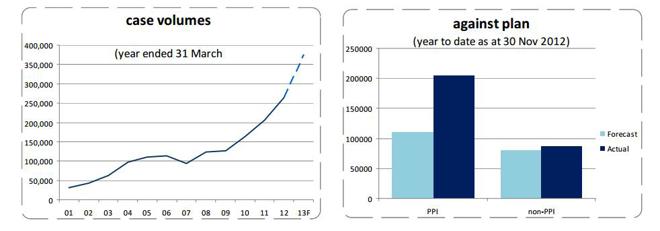

The FOS, in its plans for the coming year stated that the biggest challenge it faces is the “unprecedented numbers of PPI cases we are receiving.” They received 42% more PPI cases than originally anticipated in the financial year.

Now, the FOS are expecting to receive a further 250,000 new PPI cases – 85,000 more than originally anticipated – between now and the end of the financial year in April.

Currently, consumers are referring more than 5,000 new PPI cases per week to the FOS, which has led to them having to create roughly 1000 jobs to deal with the increased number of complaints.

So far, the cost of the PPI scandal has cost the banks almost £13bn, but it is estimated that the total cost will be nearer to £25bn. The bank to take the biggest hit so far has been Lloyds, which has put aside £5.3bn for claims.

Subjects

Business

Follow

Follow